2025 saw a shifting economic and political landscape and some interesting moves in global stock markets. As we reach year-end, Jeremy Richardson, Senior Portfolio Manager for Global Equities, reflects on the key events that have driven equity markets.

An overview

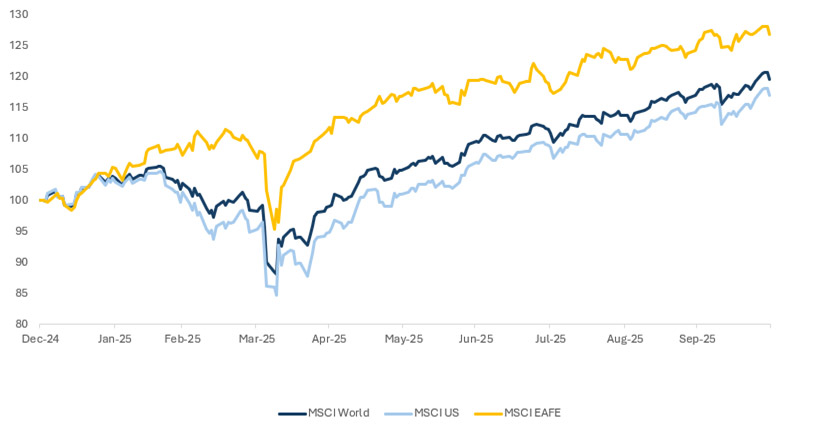

This year has been particularly strong, with equity markets delivering approximately 20% (in U.S. dollar terms) for the third consecutive year. And interestingly, as shown below, this performance has been driven by non-US markets, with the US lagging the broader equity market.

The equity year so far

Source: MSCI World Total Net Return Index, MSCI USA Total Net Return Index, MSCI EAFE Total Net Return Index, indexed to 100 at 31 December 2024; Bloomberg, as at 31 October 2025.

However, from late spring to early summer, the US started to catch up with the rest of the world. Dollar weakness has been a key theme over the year, while sustainability headwinds have impacted performance for some investors.

For example, aerospace & defence has been the standout performer this year, in contrast to food products, which have lagged behind. An identical scenario played out in the tobacco sector versus healthcare. And in terms of high versus low emissions, electric utilities have performed well while low-emitting diversified financials performed poorly.

US enterprise AI adoption inflects and CapEx responds

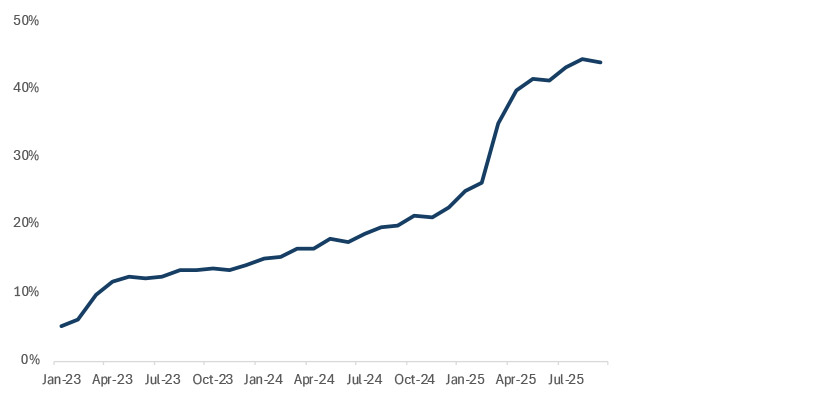

AI has been one of two major talking points this year, with a catalyst that occurred around spring. The Ramp AI Index below shows the inflection in private companies using AI, where ChatGPT went from being a chatbot to AI helping people’s working lives. This confirmed the broader AI narrative and its potentiality began to feel more tangible. CapEx forecasts are increasing, which in turn, has created a significant pick-up in activity in the industry.

Share of US businesses with paid subscriptions to AI models, platforms, and tools

Source: Ramp AI Index, as at 30 October 2025. Ramp AI Index measures the adoption rate of AI products and services amongst American businesses. Sample includes more than 40,000 businesses and billions of dollars in corporate spend, using data from Ramp’s corporate card and bill pay platform.

The second major topic of conversation in markets was changed spending priorities of European governments and the combination of a more expansionary fiscal approach within Europe combined with still-falling interest rates. This led to a ‘banks and tanks’ trade across the region. Aerospace & defence performed particularly strongly as a result of rearmament after decades of under-investment, while the ECB’s rate cuts had an effect on the short end of the curve. The volume of outstanding debt stock meant upticks at the long end of the curve. That was helpful for banks as their net interest margins increased.

‘Banks and Tanks’ have powered European equity markets

This ‘banks and tanks’ thematic was a very powerful driver in the market and, as a result, it impacted market returns; as at the end of October 2025, diversified banks and aerospace & defence represented nearly half the total returns in the MSCI EAFE Index. In addition, the largest 10 companies in the index comprised 29% of the total return with performance evenly spread.

In contrast, AI dominated in the US and, as a result, contributors to returns have been very different. As at the end of October 2025, semiconductors, interactive media & services and software were the strongest industry contributors in the MSCI US Index. Performance was concentrated in a handful of companies, with the largest 10 companies in the US delivering nearly 60% of the total return. The market went up by 20% in the US but it had a very different composition to other markets.

Quality struggles globally and Value diverges

US Quality didn’t perform particularly well this year but it struggled significantly in the rest of the world. ‘Banks and tanks’ are not great quality. They have been low returning industries for decades and the European banking industry, in particular, is ridden by excess capacity that never consolidated after the GFC. It is impossible to move risk across national borders as the lender of last resort is supported by national taxpayers, while the restructuring and de-regulation of the Draghi report has never really been delivered upon. Quality businesses have struggled this year and, instead, lower quality has actually performed better.

Value has done particularly well in Europe and especially poorly in the US. The US has been very much driven by Anti-Value as investors look to the future, whereas for the rest of the world, the ‘banks and tanks’ theme has been much more focused on the short-term.

The result has been regional philosophical challenges

This has created a philosophical headwind for active, long-term equity investors, such as ourselves, who focus on great business at attractive valuations.

In the US, there are many great businesses, but attractive valuations are harder to find. In contrast, outside the US, there are attractive valuations but not so many great businesses. We’ve witnessed a bifurcation in the market this year. In terms of positioning, we avoid the most expensive companies and, as always, we are selective in our approach.

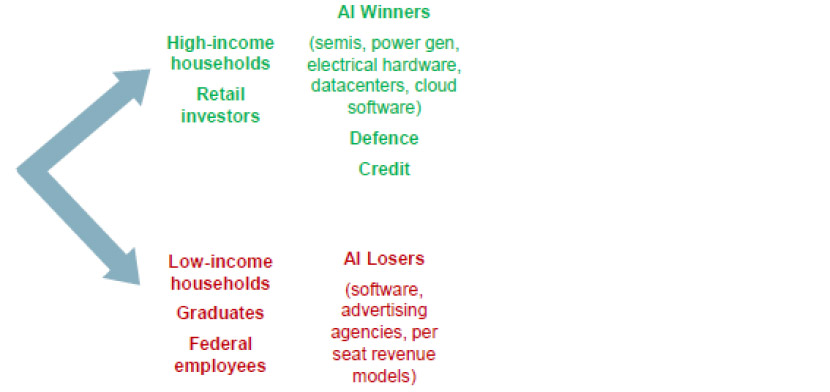

Looking ahead: a K-shaped economy and K-shaped market

This is the concept that in the US, people with money are doing well, whereas those who don’t are struggling. Those with money are very active in the market currently, whereas those without, such as graduates and young consumers, are not participating. We’re also seeing the same K-shape in the market itself, between the so-called AI winners and AI losers. This is different to the end of 2024. A year ago, the Magnificent 7 was the key theme. Now the market is AI-driven, and we see a distinction between those who are set to succeed in this new environment and those who are unlikely to.

For investors, the current environment means portfolios should be well balanced. And that means exercising good portfolio hygiene – taking profits in some of those businesses that are doing particularly well at the top end of the K but also not turning a blind eye to certain left-behind companies with strong fundamentals, which are offering attractive relative value at present.

K-shaped economy and K-shaped market

Source: RBC Global Equity team, as at 31 October 2025.

All data from Bloomberg, unless otherwise stated.